Dymicron is a medical device company offering investors an exciting opportunity to invest in an early-stage disruptor. Dymicron’s flagship product is a revolutionary cervical disc replacement that mirrors the natural motion of the spine and is made out of the hardest material in the world: Diamonds.

Degenerative disc disease in the neck leads to 800,000 people getting a surgical procedure worldwide in the front of their spine each year. This disease causes unbearable neck and arm pain, as well as disability, in millions of people every year. Current solutions like spinal fusions limit mobility and can cause other problems, while legacy artificial replacement discs are made with materials that can wear out, leaving wear debris in patients and requiring more surgeries.

As you can tell, Dymicron’s patented solution is a huge step up for this $1B industry.

As an investor, you have the opportunity to be a part of the company’s growing success. Dymicron has launched its equity crowdfunding raise, also known as a Regulation A+, to sell its shares to investors. If you are looking for investment alternatives, Dymicron’s stock may be a good choice for you.

But, is investing in Dymicron worth the risk? Keep reading to learn how to do equity crowdfunding and to decide if Dymicron stock is a good fit for you.

Is Dymicron stock one of the best medical stocks to buy right now?

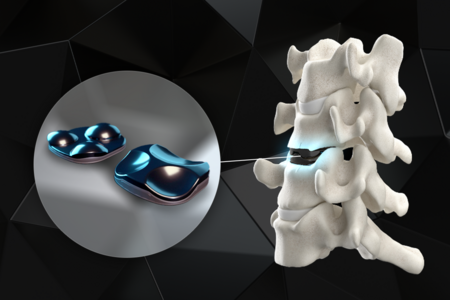

Dymicron is a privately held, innovative medical device company based in Orem, Utah. The company has developed a next-generation total disc replacement system for the cervical spine called Triadyme®-C. It is made with a uniquely engineered and patented man-made diamond material that virtually eliminates wear debris and facilitates an MRI-friendly design that mimics the natural, kinematic motion of a normal anatomic disc.

Triadyme-C is designed to address two immediate areas of concern in the total disc replacement field: minimize debris and allow patients to regain a natural motion in the spine. Dymicron’s recognition in the medical field is making it one of the best medical stocks to buy right now. In 2021, Triadyme®-C won the year’s Best New Spine Technology Award chosen by a highly accomplished panel of spine surgeons and presented by Orthopedics This Week.

Dymicron is disrupting the $1 billion cervical implant market

As an investor, it’s necessary to understand any industry before diving in with your dollars. In case you’re not familiar with the cervical implant market, here are some quick insights to get you acquainted.

Spinal and cervical implants are medical devices used by surgeons to decompress, strengthen, and stabilize the spine. They can also be used to treat a variety of spinal diseases and abnormalities.

The global spinal implant and devices market is projected to grow at a compound annual growth rate (CAGR) of 5.5% between 2021-2028, according to Gen Consulting Company.

Some of the key drivers for this growth include an increasing geriatric population, a rise in spinal diseases, and a growing demand for minimally invasive surgical procedures. The statistics surrounding the global size of the market vary, but many reports place the value of the artificial cervical disc market well over $1 billion. This report shows the global spine implants market is expected to grow from $11.32 billion in 2022 to $12.33 billion in 2023 at a compound annual growth rate (CAGR) of 8.9%. In 2019, surgeons in the United States performed 1.62 million spinal-related surgeries.

One of the keys to understanding any industry is to know its pain points. Within the cervical implant market, legacy disc replacements can fail because the metal and plastic components can wear out over time, leaving debris in the body. In fact, 55% of orthopedic total joint failures are caused by wear particles from plastic and metal materials.

Dymicron is quickly gaining media attention for medical companies to invest in and an alternative investment for folks who want to diversify their portfolio.

Dymicron earned 83 patents for its Triadyme®-C product

Dymicron’s solution to the cervical implant market’s pain points is its flagship product, Triadyme®-C. It is made with polycrystalline diamond, which is one of the hardest materials on Earth and therefore will not wear out or leave debris. In fact, it is designed to last an entire lifetime. Additionally, artificial disc patients have a shorter recovery and can return to work within 38 days. From a cost perspective, motion preservation is about $6,000 cheaper for the patient long term compared to other fusion options.

Dymicron’s President Jeff Bennett stated, “With its natural motion design and Polycrystalline Diamond material, we feel like Dymicron can make an immediate impact in the cervical disc replacement market. Based on our technology and design, we’re confident we can provide a great option to patients suffering from degenerative disc disease and become the leader among the next generation of cervical disc replacement devices.”

Dymicron’s Triadyme - C Artificial Cervical Disc won the 2021 Best New Spine Technology Award presented by Orthopedics This Week, a widely read publication in the orthopedics industry.

This was the 13th Annual Spine Technology Award, voted on by a highly accomplished panel of spine surgeons who recognize exemplary and innovative technologies developed to improve spine care. The award is graded on originality, clinical relevance, the likelihood of improving patient outcomes, cost-effectiveness, and if the surgeons on the panel would use the technology.

Dymicron’s consistent stellar recognition within the medical field proves it is one of the best medical stocks to buy right now.

Is Dymicron a good investment?

If you’re wondering, “should I invest in Dymicron?”, at Money & Mimosas we encourage you to ask yourself three questions:

What are the potential roadblocks?

What is the potential growth or upside?

How does this align with my values and/or overall investment strategy?

We see two potential roadblocks for Dymicron. One is that their flagship product (Triadyme-C) is not yet approved in the United States or its territories. Dymicron is in the FDA approval process and hopes for it to be completed successfully by 2026.

The second roadblock is the competitive landscape. Major players in the spine implants market are Medtronic, Depuy Synthes - Johnson & Johnson, Stryker, Globus Medical, NuVasive, ZimVie, Alphatec Holdings, and Orthofix. However, only three of those major companies currently have a viable artificial cervical disc to sell.

Despite these roadblocks, we see huge potential for Dymicron. Starting with its leadership team.

The President and COO, Jeff Bennett, has extensive experience in the medical device industry. Before joining Dymicron, he oversaw a 100 percent increase in revenue during his two-and-a-half-year tenure as General Manager of Merit Medical’s Richmond Division. In 2021, Dymicron announced that it had appointed Gunther Peeters as Senior Vice President of Commercial Operations. Peeters has over 15 years of spine industry experience. Their team also includes Ted Bird with over 35 years of global commercial experience in the medical device arena, including 30 years in the spine industry specifically. As well as Eric Lange who joined Dymicron in May 2019 to spearhead the company's efforts to gain US approval for the Triadyme-C Cervical Disc. Lange has over 27 years of experience in the spinal device industry, (20 with the market leader, Medtronic) and has over 100 issued patents.

In addition to its stellar team, Dymicron has had tremendous traction. Over 500 of its patented cervical discs have been successfully implanted outside of the US and the team has secured 83 patents.

Last, but certainly not least, the company’s unique product is solving severe pain points that have yet to be addressed in the billion-dollar cervical implant market. The cervical implant market will continue to grow and Dymicron is positioning itself to be the leader.

When it comes to your values, we encourage you to research the team, and the company’s overall stance on the environmental + social causes you care about, and conduct your own due diligence on how Dymicron could fit into your personal investment strategy.

How to invest in Dymicron:

Dymicron is currently offering shares at $5.75.

The process of investing is really easy. You head over to the Dymicron stock page and enter your email information into the invitation box. From there, the website will walk you through the seamless process of becoming an investor with Dymicron.